Global credit ratings agency S&P, in its May 16 report, affirmed Rwanda’s long and short-term sovereign credit ratings at ‘B+/B’, maintaining a stable outlook despite growing external financing needs and fiscal pressures linked to major infrastructure spending.

The agency said the stable outlook reflects the government’s ongoing efforts to manage fiscal and external imbalances while maintaining strong economic growth supported by concessional borrowing loans offered at below-market rates with longer repayment periods.

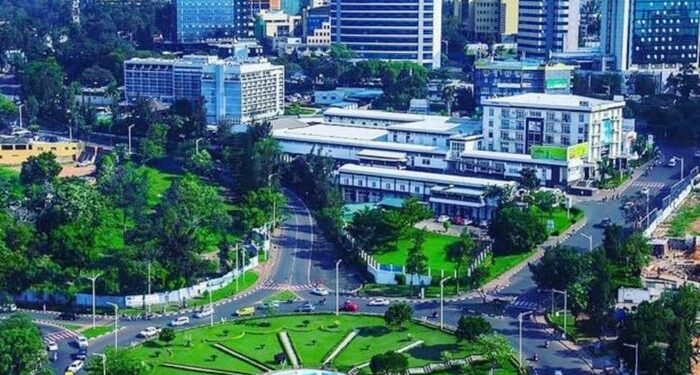

Rwanda’s economy expanded by 8.9% in 2024, and S&P projects it will grow at an average rate of more than 7% annually through 2028. According to the agency’s report, this performance is underpinned by increased public investment and improvements in agriculture, industry and services.

Real GDP per capita has increased by 4.4% annually over the past decade, one of the fastest rates among countries rated by S&P although it remains low in global terms, averaging about $1,200 between 2025 and 2028.

Government debt is expected to peak at 74.4% of GDP in 2026 before declining to 69.5% by 2028. Most of Rwanda’s debt roughly two-thirds that comes from concessional sources, keeping repayment burdens relatively manageable. Still, the country’s interest bill is expected to reach 9.6% of government revenue in 2025, up from under 5% in 2019, reflecting reduced global access to cheap credit.

One of the key pressures on Rwanda’s fiscal position is the $2.6 billion Bugesera International Airport project. S&P estimates the government will borrow about $1.2 billion between 2025 and 2028 to finance the airport and recapitalize national carrier RwandAir. Qatar, which holds a 60% stake in the airport and 49% of RwandAir, is expected to fund the remainder through foreign direct investment.

The airport is expected to boost logistics and regional air connectivity once complete around 2028–2029. However, S&P warned of potential risks, including delays, cost overruns, and the challenge of securing affordable commercial financing if concessional options fall short.

Despite these concerns, S&P said Rwanda’s ability to repay debt remains strong, supported by disciplined fiscal management and an expanding tax base. The government has focused on digital tax systems and widening taxpayer coverage to improve domestic revenue collection.

Inflation remained within the National Bank of Rwanda’s 5% ±3% target band throughout 2024. It rose slightly to 6.5% in March 2025 due to food price increases linked to erratic rainfall. The central bank is expected to proceed cautiously with interest rate adjustments after some easing in 2024.

Rwanda’s external position remains stable. Foreign exchange reserves stood at $2.4 billion at the end of 2024 and are projected to average $2.8 billion through 2028. These reserves are considered adequate to meet the country’s external debt obligations, particularly as Rwanda’s exposure to expensive commercial debt is limited.

To support climate resilience and long-term growth, Rwanda has committed $450 million over four years to strengthen its agriculture sector, which employs a majority of the population and contributes about a quarter of GDP. The country was the first in Africa to join the International Monetary Fund’s Resilience and Sustainability Facility and continues to receive support under multiple IMF programs.

While access to formal banking services remains limited with less than 40% of adults using banks, Rwanda’s financial sector is expanding. Total banking assets now represent 45% of GDP. S&P noted that the sector is well-capitalized with sufficient liquidity, even as nonperforming loans rose slightly in 2024.

Looking ahead, S&P said it could raise Rwanda’s rating if the country achieves stronger-than-expected economic and fiscal outcomes and if political risks diminish. A downgrade is possible if access to concessional funding weakens or if unforeseen shocks strain the economy.

The rating reaffirms investor confidence in Rwanda’s macroeconomic stability, even as the country navigates large-scale infrastructure ambitions and global financing shifts.